The Future of Final Expense Insurance for Veterans: Predictions and Emerging Trends

- April 26, 2024

- 2 minutes

Final Expense Insurance has often been regarded as an invaluable asset for ensuring a peaceful posthumous transition for loved ones. This insurance product, characterized by its coverage of end-of-life expenses such as funeral costs, medical bills, and outstanding debts, has been held in high regard especially amongst the veterans who have diligently served our nation.

However, as the dynamics of our world shift in response to technological advancements, regulatory changes, and evolving societal norms, it's essential to comprehend the future trajectory of Final Expense Insurance, specifically for veterans.

The first noteworthy trend is the increasing digitization of the insurance industry. Technology is no longer an ancillary tool; it has become central to the provision of insurance services. The traditional brick-and-mortar model of insurance companies is gradually giving way to a more digital, agile, and customer-centric approach. As such, veterans, many of whom belong to the baby boomer generation, are increasingly becoming adept at using digital platforms to access insurance products.

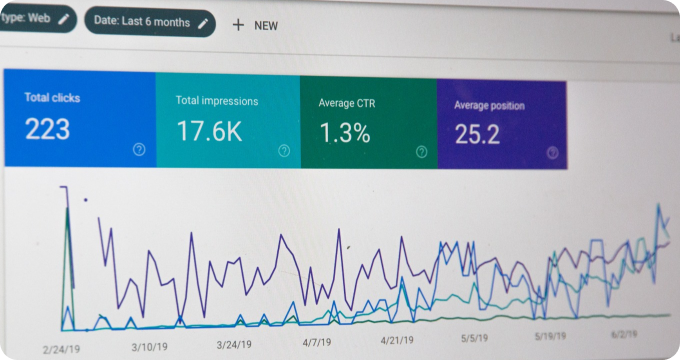

This trend is not merely speculation - empirical data from Pew Research Center indicates that from 2012 to 2019, internet usage amongst seniors aged 65 and above rose from 53% to 73%. This increased digital literacy amongst seniors could potentially lead to a surge in demand for digital platforms that provide Final Expense Insurance services.

Another emerging trend is the increasing prevalence of personalized insurance. This is largely driven by advancements in data analytics and machine learning. Insurance companies are now better positioned to analyze complex sets of data and derive insights into the risks associated with a particular individual's profile. This allows for the provision of insurance products that are tailored to the unique needs and risk profile of the individual.

As such, veterans may soon witness a surge in personalized Final Expense Insurance products, characterized by flexible premiums, coverage options, and payout methods. These would cater to their specific needs, circumstances, and risk profiles. This trend bodes well for veterans as it enables them to obtain the maximum utility from their insurance policies while minimizing the waste that comes with one-size-fits-all policies.

However, personalization also implies an increased scrutiny of veterans' health status and lifestyles, potentially leading to higher premiums or denial of coverage for those with significant health risks. This is a trade-off that veterans will need to contemplate as they navigate the future of Final Expense Insurance.

Regulatory changes are another critical factor shaping the future of Final Expense Insurance for veterans. The Affordable Care Act (ACA), for instance, has implications for the availability and cost of Final Expense Insurance. It prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. Since many veterans suffer from health issues related to their service, this regulatory mandate could potentially make Final Expense Insurance more accessible and affordable for them. However, the ACA's future remains uncertain, and any changes could significantly impact the accessibility and cost of Final Expense Insurance for veterans.

The future of Final Expense Insurance for veterans is also likely to be shaped by societal shifts. An aging population, changing funeral practices, and evolving attitudes towards death and dying are all factors that could influence demand for such insurance. For example, increased acceptance of cremation, which typically costs less than traditional burial, could reduce the demand for Final Expense Insurance.

To conclude, while the future holds many changes for Final Expense Insurance, it remains a critical financial tool for veterans. These changes, while presenting some challenges, also offer opportunities for more personalized, accessible, and cost-effective insurance coverage. As veterans navigate the future of Final Expense Insurance, they would do well to stay abreast of these changes and adapt their insurance strategies accordingly.

Learn More

Don't miss out on the opportunity to secure peace of mind for your loved ones; delve deeper into our blog posts to understand the immense benefits of final expense insurance for veterans. They are encouraged to explore our comprehensive rankings of Best Final Expense Insurance For Veterans to make an informed decision.

Popular Posts

-

Final Expense Insurance For Veterans Industry Report: Essential Findings and Insights

Final Expense Insurance For Veterans Industry Report: Essential Findings and Insights

-

Debunking X Myths About Final Expense Insurance For Veterans

Debunking X Myths About Final Expense Insurance For Veterans

-

Ask These Questions to Your Insurance Agent to Choose the Right Final Expense Insurance for Veterans

Ask These Questions to Your Insurance Agent to Choose the Right Final Expense Insurance for Veterans

-

How to Hire a Reliable Final Expense Insurance Agent for Veterans

How to Hire a Reliable Final Expense Insurance Agent for Veterans

-

11 Things I Wish I'd Known About Final Expense Insurance For Veterans Before Purchasing a Policy

11 Things I Wish I'd Known About Final Expense Insurance For Veterans Before Purchasing a Policy